黑天鵝 VS 灰犀牛 Black Swan VS Grey Rhino

“黑天鵝”指的是那些發生機率低、極其罕見且不可預測的事件。

"Black swan" refers to events that have a low probability of occurrence, are extremely rare and unpredictable.

“黑天鵝”這個概念出自納西姆·塔勒布的《黑天鵝:如何應對不可預知的未來》,黑天鵝風險是客觀存在的,你可能意識不到,會突發,會造成巨大的衝擊。像這次的新冠疫情就是一次黑天鵝類的風險,放到人身上,比如說意外、突發疾病就屬於黑天鵝風險。

The concept of "black swan" comes from Nassim Taleb's "Black Swan: How to Deal with the Unpredictable Future". The risk of black swan exists objectively. You may not realize it, it will happen suddenly, and it will cause a huge impact. Like this new crown epidemic, it is a black swan risk, which is placed on people. For example, accidents and sudden diseases are black swan risks

“灰犀牛”指的是那些經常發生在你眼前,卻沒有得到充分重視的大機率風險事件。

"Gray rhino" refers to those high-probability risk events that often happen in front of your eyes but are not fully valued.

“灰犀牛”這個概念是著名學者米歇爾·渥克在一本叫《灰犀牛:如何應對大機率危機》的書裡提出的。灰犀牛體型龐大,常給人一種行動遲緩、體態愚笨的錯覺,如果你在非洲草原上看到它,通常不會感到害怕。但實際上,灰犀牛的殺傷力非常大,一旦發起進攻,後果非常嚴重。而我們卻往往會被它的表象迷惑,低估了它的風險。

The concept of "Gray Rhinoceros" was proposed by the famous scholar Michel Walker in a book called "Gray Rhinoceros: How to Deal with High Probability Crisis". The gray rhino is large in size and often gives people the illusion of slow movement and stupid posture. If you see it on the African grasslands, you usually don't feel scared. But in fact, gray rhinos are very lethal, and once they attack, the consequences are very serious. But we are often confused by its appearance and underestimate its risks.

什麼是商譽?What is Goodwill?

2006年的《企業會計準則第20號》第十三條規定,“購買方對合併成本大於合併中取得的被購買方可辨認淨資產公允價值份額的差額,應當確認為商譽”。

Article 13 of the 2006 "Accounting Standards for Business Enterprises No. 20" stipulates that "the difference between the purchaser's merger cost and the fair value of the acquiree's identifiable net assets obtained in the merger shall be recognized as goodwill".

用大白話說一遍就是:如果購買價格高於對方的賬面價值,這兩者之間的差額,就是商譽。商譽是財務報表上的一個資產類別。

In short: if the purchase price is higher than the other's book value, the difference between the two is goodwill. Goodwill is an asset class on financial statements.

假設今天買方企業收購了一家賬面只值10億元的公司,但是實際支付了30億元的收購價。買方企業為什麼願意多付出20億元呢?因為公司有很多有價值的無形資產,比如品牌、社會關係、團隊協作能力等等,這些資源比財務報表中看到的資產要多。買方企業預計這些資源未來能給自己帶來超過20億元的價值,所以願意為這次併購多支付20億元。

Suppose today that the buyer’s company acquired a company with a book value of only 1 billion yuan, but actually paid a purchase price of 3 billion yuan. Why is the buyer company willing to pay an extra 2 billion yuan? Because the company has many valuable intangible assets, such as brand, social relations, teamwork capabilities, etc., these resources are more than the assets seen in the financial statements. The buyer company expects that these resources will bring itself more than 2 billion yuan in value in the future, so it is willing to pay an additional 2 billion yuan for this merger.

商譽的大小和買方企業對被收購企業未來的前景判斷有關。當對被收購企業越樂觀,認為它未來能創造的價值越大的時候,收購溢價就越高,賬面上形成的商譽也就越多。

The size of goodwill is related to the buyer's judgment on the future prospects of the acquired company. The more optimistic about the acquired company and the greater the value it can create in the future, the higher the acquisition premium and the more goodwill formed on the books.

為什麼商譽是灰犀牛? Why is goodwill a gray rhino?

為什麼說商譽是企業併購活動中的“灰犀牛”呢?因為商譽有暴雷後大幅貶值的風險。

Why is it said that goodwill is the "gray rhino" in corporate M&A activities? Because there is a risk of a sharp depreciation of goodwill after a thunderstorm.

一旦暴雷就讓收購企業產生大幅虧損,陷入危機。有的公司甚至因為商譽暴雷把自己的市值都虧損掉了。

Once a thunderstorm causes the acquired company to incur substantial losses and fall into crisis. Some companies even lost their market value due to a thunderstorm of goodwill.

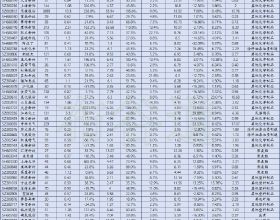

例如,盛運環保,市值23億元,2018年因為商譽虧損25億元,虧損超過公司市值。南寧糖業,市值17億元,2018年因為商譽虧損13.9億元。

For example, “Shengyun Environmental” has a market value of 2.3 billion yuan. In 2018, it lost 2.5 billion yuan due to goodwill, which exceeded the company's market value. Nanning Sugar, with a market value of 1.7 billion yuan, lost 1.39 billion yuan in 2018 due to goodwill.

為什麼商譽會暴雷? Why is goodwill significantly impaired?

因為商譽是基於對被收購企業未來的判斷估計出來的,有很大的主觀性。

Because goodwill is estimated based on the judgment of the acquired company's future, it is very subjective.

當事後發現被收購企業不靠譜的時候,就會出現商譽暴雷。

When it is later discovered that the acquired company is not reliable, there will be a goodwill thunder.

比如之前的例子中,我預計被收購的公司未來能給我創造20億的價值,但是,幾年後當我發現這家公司帶不來20億的時候,這家公司的商譽就不值20億了。這時候,會計上就要求企業進行一個處理,叫商譽減值。

For example, in the previous example, I expected the acquired company to create 2 billion worth of value for me in the future. However, a few years later, when I discovered that this company could not bring 2 billion, the company’s goodwill was not worth it. 2 billion. At this time, the accounting requires the enterprise to conduct a treatment called impairment of goodwill.

針對商譽收購雙方是如何博弈的?How do the two parties compete for the acquisition of goodwill?

在併購前,收購方為了自我保護,一般先簽一個3至4年的業績對賭協議,也就是要求被收購企業每年達到一定的業績標準。

Before the acquisition, in order to protect itself, the acquirer generally first signs a 3-4 year performance betting agreement, which means that the acquired company is required to meet a certain performance standard every year.

如果達不到,對方則需要進行股份或現金補償被收購企業同意這個條件,才願意支付股權的對價款。

If it is not met, the other party needs to make stock or cash compensation for the acquired company to agree to this condition before it is willing to pay the consideration for the equity.

你有張良計我有過牆梯,一些企業是隻顧眼前不顧將來,為了眼前能賣個高價,會對未來幾年的業績做出極高的承諾。

Both parties have their own plans. Some companies just look at the present and ignore the future. In order to be able to sell at a high price, they will make extremely high commitments to their performance in the next few years.

這實際上是給買方企業挖了個大坑。因為研究發現,被收購企業往往會盡量扛過業績承諾期,但是之後的業績就會出現“大變臉”,當然也有被收購方實在扛不過去,甚至連承諾期沒結束,就已經破產了,買方企業就要為此背鍋,進行鉅額的商譽減值。

This is actually a big hole for the buyer's company. This is because research has found that the acquired company tends to survive the performance commitment period as much as possible, but there will be a "big face change" in the subsequent performance. Of course, there are also acquired parties that can't handle it, and even the commitment period is not over, and it has already gone bankrupt. The buyer's company will have to carry out a huge impairment of goodwill for this purpose.

2017年6月,寧波東力宣佈收購深圳年富供應鏈。年富供應鏈這家公司曾經非常風光,是深圳市重點物流企業和中國民營500強企業。寧波東力一看這家公司這麼有實力,所以儘管當時年富供應鏈的淨資產賬面價值只有2.7億元,但是寧波東力卻花了21億進行收購,也就是產生了超過18億的商譽。

In June 2017, Ningbo Dongli announced the acquisition of Shenzhen Nianfu Supply Chain. Nianfu Supply Chain Company used to be very prosperous. It was a key logistics company in Shenzhen and one of China's top 500 private enterprises. Ningbo Dongli saw that this company was so powerful, so even though the net asset book value of the supply chain for the rich at that time was only 270 million yuan, Ningbo Dongli spent 2.1 billion yuan on the acquisition, which is 1.8 billion yuan in goodwill.

當時這兩家公司也進行了業績對賭,結果沒想到,蜜月期還沒結束,意外就來了。年富供應鏈被爆出大肆進行財務造假隱瞞真實業績,公司法人和一眾高管被抓,公司宣告破產。年富供應鏈商譽暴雷這件事,讓寧波東力的股價遭遇累計20%的跌幅;公司原本預計2018上半年淨利潤在1.1億至1.4億元之間,最後因為被年富供應鏈拖累,實際產生了31.5億元的虧損。

At that time, the two companies also conducted a performance gambling. As a result, unexpectedly, the honeymoon period hadn't ended yet, and an accident would come. Nianfu's supply chain was exposed to large-scale financial fraud to conceal real performance, the company's legal person and a group of executives were arrested, and the company declared bankruptcy. The goodwill thunder of Nianfu’s supply chain caused Ningbo Dongli’s share price to suffer a cumulative decline of 20%. The company originally expected a net profit of 110 million to 140 million yuan in the first half of 2018. The drag actually produced a loss of 3.15 billion yuan.

高估值、高溢價併購是商譽減值產生的根源。但商譽的估值就像是一頭灰犀牛,雖然來得緩慢,但發生的機率大,且殺傷性極強。

High valuation and high premium mergers and acquisitions are the root causes of goodwill impairment. But the valuation of goodwill is like a gray rhino. Although it comes slowly, it has a high probability of occurrence and is extremely lethal.

在併購過程中,買方企業需要判斷被收購企業的財務情況,收購時的外部市場環境和競爭情況,以及被收購方與收購方之間的關聯,以判斷商譽減值的可能性。

In the process of mergers and acquisitions, the buyer company needs to judge the financial situation of the acquired company, the external market environment and competition at the time of the acquisition, and the relationship between the acquired party and the acquirer to determine the possibility of goodwill impairment.